Profitable Binary Option Trades – December 2013 Review

December 5th was a good day for trading thanks to two large central bank meetings: the Bank of England in morning GMT, followed by the European Central Bank in the afternoon. The coincidence of these meetings of central banks which control the economies of two of the most traded currencies in the world tends to provide ample volatility – and with it, profit-making opportunity. For those with some knowledge of technical option theory, this is clearly evidenced by overnight EUR options trading for 16 vol rather than a typical 10 vol.

EURUSD has had a topsy turvy ride of late, with a very quick loss of 5 big figures in late October/early November, followed by a steady retracement of almost all that move in the following weeks. The reasons for this retracement include an improvement in European economic figures, a general weakness of the USD as dovish comments from the Fed in recent weeks have reinforced the notion that QE is set to continue in full flow for at least the short term, and simply the fact that the market as a whole is already overstretched in short positioning – 85% of retail positions are currently short EURUSD.

The counterbalancing arguments are the strong ADP job reports out yesterday in the US, hinting at strong NFP and thus taper fears on Friday, and suggestions that the ECB is considering dipping into negative rates to fight low inflation in the Eurozone.

It is my opinion however that it is extremely unlikely that the ECB will cut deposit rates to negative since they are still projecting annual HICP inflation (their preferred measure) at 1.5% for 2013 and 1.3% for 2014, far from deflationary levels and not dramatically lower than their target of 2%. Indeed, Draghi classified inflation risks as ‘broadly balanced’ in his last meeting.

Given this, the balance of fundamental and positioning drivers points towards EURUSD closing up at the end of the day, post-ECB.

Furthermore, on a technical level the retracement since the late October highs has now powered through not only the crucial 50% level that indicates the market is bound towards the peak again, but also the 61.8% level which reinforces that signal.

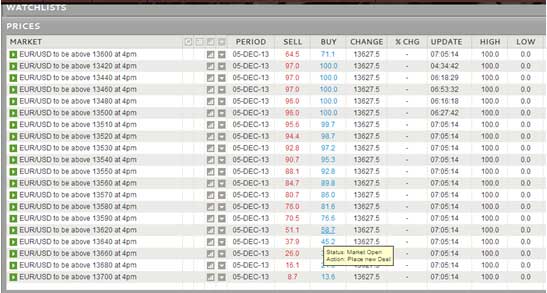

Hence on the balance of the above factors, I choose to take a long position in EUR USD via binary options. With spot at 1.3620, I opt for ‘EUR USD to be above 1.3620 at 4pm’ at a price of 58.7, which should give the market ample time to orient itself correctly post-ECB.

Indeed, after a decidedly blasé press conference, EURUSD has rallied strongly by 4pm to 1.3665 and my option ends up being in the money.

GBP USD has performed impressively in the last few weeks, going from the 1.58 region to 1.64 where it is now. The strength has come largely on the back of improved figures for the British economy – falling unemployment, improving GDP figures far ahead of mainland Europe, and an uptick in manufacturing PMI. In my opinion, part of the renewed strength has also been due to the view that GBP is a safe haven moreso than other major currencies. The Eurozone’s dysfunctions are still uppermost in the minds of many fund managers entrusted with low-risk portfolios; the sharper ones also consider the USD to bear some risk due to continual Congressional deadlocks which only looks set to repeat in early January when the temporary funding agreed in October runs out. By contrast, the British government remains stable and fiscally responsible, at least relatively. In the medium term, I like being long the GBP.

However trading binary options mandates looking at both positioning and technicals to inform on a shorter timeframe. GBP ramping 6 big figures in 2 weeks, far outpacing the gains of EUR (and most every other currency) is ripe for a moderate correction at this stage. Looking back over the last year, we have cleanly broken the post 2008 highs – this was always on the cards once we got close to the 1.60 area, but now that we have gone 2 big figures clear there is time for the market to take a breath.

Although there is an Autumn Statement and Bank of England meeting scheduled today, it is very unlikely there will be any surprises from either (the Autumn Statement details have already been leaked and there is nothing too hair raising in them). Additionally, retail positioning is overstretched with 77% of them long.

Last but not least, I also like taking a short GBP position because it is a partial hedge of my long EUR position – the two trade with a fairly high correlation. In this way if there is an unexpected USD-related announcement, it should affect both my trades equally and hence I will break even. In effect I end up taking a long EUR GBP position; this carries less risk than an outright EUR USD or GBP USD position alone.

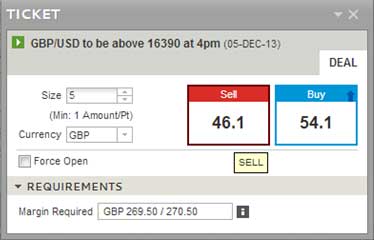

With spot at 1.6390, I choose to sell the ‘GBP USD to be above 1.6390 at 4pm’ option for 46.1%.

As it turns out there is almost no reaction to either the Autumn Statement or the BoE release, as I expected, and GBP drifts lower to close at 1.6320 at 4pm. I am quite fortunate indeed to have both my EUR and GBP trades work out exactly as expected!

The S&P500 index has had a bumper year, having climbed an impressive 21% this year. With improving economic figures providing a tailwind, and a resolutely dovish Fed suggesting QE and low rates will prevail for some while to come, the outlook continues to be rosy in my view.

However, some key technical indicators suggest the short term action may be to the downside. Look at the chart below. There is a strong trendline of support starting from the lows of the 10th of October which has now been breached, and comfortably so. Although I do believe the uptrend to reassert itself, I expect a correction first.

Furthermore, the chart is annotated with 2 moving averages – the 50 day and the 100 day – and these have typically been excellent as supports/resistances. As one can see, where we are currently looks to be capped above by both lines.

That is the short-term technical pictures in the S&P500. What about the impact that the ECB and BoE announcements will have? Well, the BoE rarely impacts the S&P to any large extent, and today it is doubly unlikely with little of note on the table. The ECB can have an impact though. If they were to introduce negative rates, it is highly likely that the S&P500 would react favourably to the easier monetary policy. However, as I discussed in my EUR trade, I think it is improbable to the point of almost ignorable that the ECB will introduce negative rates at this juncture; with no change, I expect the technicals to assert themselves today.

With spot at 1790, I choose to sell the ‘US500 to be above 1791’ option at 49.5. By the close of the index, it has traded down to 1784 and my option returns me 100% profit.

Market anticipation for the last FOMC meeting of the year has reached fever pitch as speculation is rife on whether tapering of their longstanding QE programme will be announced today. The majority of banks and institutional investors believe we will see this later, in January or March. Although the economic figures have been substantially improved in recent readings, I am inclined to go with the consensus on this one and say that tapering is unlikely given Bernanke’s dovish bent.

A day like the FOMC presents an interesting conundrum to traders. For a start, technicals are generally thrown out of the window, as the announcement takes precedence. Next, traders have to think about which instrument best captures their view. For example, though I could trade currencies (and I do have a USDJPY position in fact), stocks generally respond with greater strength to FOMC minutes and in a more predictable manner. Increased volatility is increased opportunity, so I decide to go with the S&P500. Given my views above on tapering, and additionally my longer term view of the S&P direction, I like being long through the announcement.

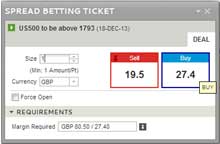

Because of the generally high volatility that FOMC provides, binary users can obtain very strong profits by choosing option levels that are some way away. With spot at 1782, I opt to buy the ‘US500 to be above 1793’ option for 27.4%. This requires only a 0.6% move in S&P500 in my direction for me to make almost 400% on my money invested.

In the event, the actual announcement and subsequent price action is extremely interesting. There is a surprise taper decision of $10 billion which catches the market off guard. The immediate market reaction is to sell off on this. However, the minutes also contain the key phrase ‘exceptionally low rates until jobless rate falls well past 6.5%’, a more dovish outlook on rates than previously. With these contrasting signals the market ends up reversing its first move and rallies sharply to close the day above 1800! The increased rate dovishness seems to take precedence over a reduction of $10bio in monthly QE – after all, that leaves $75bio of ongoing QE still occurring.

Even though I (as well as the majority of the market) were not expecting any tapering, the trade still ended up working in my favour as the deep dovishness of the current FOMC board members prevailed and they tempered their tapering with far more loose interest rate guidance. In any case, I gladly collect my 400% returns. The market looks set to be very interesting in the next few months!