Nadex Binary Options Strategies

There are several trading strategies for the binary options market. Some are suitable for the US style of binary options found on NADEX or Cantor Exchange, while others are better suited to the online trading platforms which are regulated.

There are several trading strategies for the binary options market. Some are suitable for the US style of binary options found on NADEX or Cantor Exchange, while others are better suited to the online trading platforms which are regulated.

When it comes to US exchange traded options, there are basically five major binary option trading strategies available:

- In-the-money (ITM)

- Deep-in-the-money (DITM)

- At-the-money (ATM)

- Out-of-the-money (OTM)

- Deep-out-of-the-money (DOOM)

It is an uncontestable fact that any trader who trades on the NADEX or Cantor Exchange platform must understand these strategies, and exactly what situations would warrant playing one strategy over another. The goal of this article is to demystify these strategies and enable traders understand exactly when to use these strategies. We now take our time to explore these strategies one after the other. The strategies to be covered here are the core strategies. Other more exotic strategies will be covered in a subsequent article.

In-the-Money .vs. Deep-in-the-Money

The definition for an in-the-money option on NADEX is a bit different from what traders who trade European style binary options have been used to.

- For a Call option, an in-the-money option strategy works when binary option’s current market value is above the entry price (strike price) of the underlying asset.

- For a Put option, an in-the-money option strategy works when binary option’s current market value is below the entry price (strike price) of the underlying asset.

An in-the-money option is not necessarily used to define an option that is profitable. It only refers to a binary option that is worthy of being exercised.

The in-the-money binary options strategy is a trend-following approach. This strategy is used when the trader expects the asset to maintain a strong trend for some time to come. Such a trend is obviously as a result of market fundamentals, pushing an asset in a particular direction.

Take for instance the occasion of the South African miners’ strike of 2012/2013 which caused prices of platinum to skyrocket due to diminished supplies. This was a fundamental factor that pushed prices towards a particular direction, resulting in a very strong trend which lasted for some time.

The first step towards deciding if the in-the-money strategy is the right one to use is to check the news headlines and then scan the graphs of the asset to see if the trend in the asset is strong and in the direction that the news headlines are pointing to. A good way to gauge this is to see if the trend makes a 37- to 45-degree angle to the horizontal, or whether the price action has broken through its 50-day moving average. Usually the trend is confirmed by the price action making a sequence of new daily highs and new daily lows. If a determination has been made that the asset is trending and this is backed up by strong fundamentals, then it would make sense to do an in-the-money or deep-in-the-money strategy. Another point that must be noted is that the trend direction must remain strong for a reasonable amount of time.

Usually, deep-in-the-money trades attract higher commissions because the expected outcome of the trade is that it will be settled in profit territory. The deep-in-the-money trader is essentially a trend trader and is joining the herd.

At-the-Money .vs. Near-the-Money

By the very definition of a binary option being “at-the-money”, the asset price on expiry is going to be at the market price when the trade was opened, or very near to it (near-the-money). When the trader examines the charts and the trend of the asset is starting to table out in a plateau, then it may be a safer play to go for an at-the-money (ATM) strategy.

By the very definition of a binary option being “at-the-money”, the asset price on expiry is going to be at the market price when the trade was opened, or very near to it (near-the-money). When the trader examines the charts and the trend of the asset is starting to table out in a plateau, then it may be a safer play to go for an at-the-money (ATM) strategy.

At- or near-the-money options contracts usually attract a higher premium than out-of-the-money binary options, but they are usually cheaper than in-the-money binary options.

A binary option with an entry price of $29.80 and a current market price of $30 is said to be near-the-money, since the difference between the strike price and the market price is just 20 cents. Generally speaking, options in which the difference between the strike price and market value is less than 50 cents are considered to be near the money.

There are a number of reasons why it may be better to play an at-the-money strategy.

- When the market is in a sideways pattern such as in a sideways channel.

- An at- or near-the-money binary option trade can also be used if the price of the asset is hovering near its support or resistance point, in which case the price is prone to testing the resistance or support level several times before it either breaks the key level, or retreats from it totally.

In this chart above, we see the price action testing the support line many times. When the price action is doing this, then a range will tend to form because price action will not be swinging too wildly from one end to the other. In this situation, you can use an at-the-money strategy to trade the binary option on this asset.

Out-of-the-Money .vs. Deep-Out-of-the Money

The out-of-the-money (OTM) binary option trade is mostly used to take advantage of very high trade volatility. Out of the money binary options trade usually attract very low premiums. Trades taken with deep-out-of-the-money (DOOM) binary trades are usually considered trades with improbable outcomes, but if the outcome works out as the trader predicted, the payout can be quite huge.

For example, let us consider a stock with a market price of $30. The binary options contracts with strike prices above $20 would be out of the money calls, while the binary options with strike prices below $20 would be out of the money puts.

In the case of a stock that is trading at $30, a call trade with a $29 strike price may cost $2.50, while a contract with a $31 strike may be priced at $1.00. If the stock appreciates to $32 by the time the trade contract expires, the $29 call would be trading at around $5.00, while the $32 call would be trading around $2.00. In this case, the gross return for the $31 call would be higher than the return for the $29 call.

Combination Strategies

Most times, it is not always recommended to use one strategy exclusively, and the reason is not far-fetched. Markets and price action can be unpredictable, and it is good to use a strategy which can put this unpredictability in your favour. This is where combination strategies come in.

Most times, it is not always recommended to use one strategy exclusively, and the reason is not far-fetched. Markets and price action can be unpredictable, and it is good to use a strategy which can put this unpredictability in your favour. This is where combination strategies come in.

Combination strategies typically make use of two or three different strategies to as to enable the trader to benefit from a variety of market conditions within a typical trading week.

Regardless of the combination, option strategies should match market conditions. The following combinations can be used:

- Three deep-in-the-money trades with one deep-out-of-the-money trade.

- Three deep-out-of-the-money, three deep-in-the-money, and four at-the-money trades.

- Three deep-in-the-money contracts with one deep-out-of-the-money contract.

- One-third deep-out-of-the-money, one-third deep-in-the-money, one-third at-the-money.

Conclusion

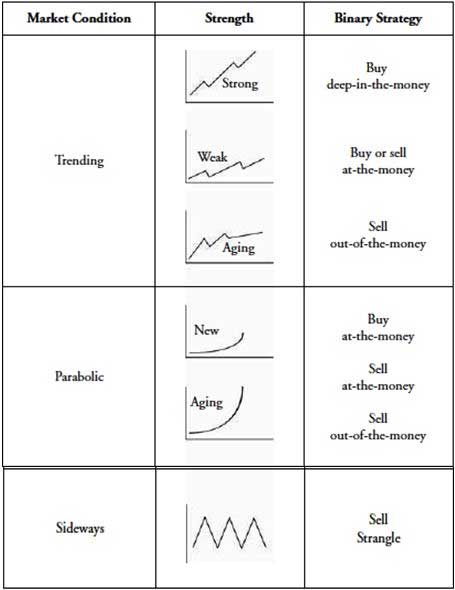

The snapshot above is a summary of the trade strategies that we have discussed.

- Strongly Trending Markets: Apply an in-the-money or deep-in-the-money strategy.

- Weakly trending market: Buy or sell an at-the-money strategy.

- Aging Trend: Sell an out-of-the-money strategy to take advantage of the expected market reversal.

- Strongly trending parabolic: buy an at-the-money strategy

- Aging parabolic: Either sell an out-of-the-money strategy or sell an at-the-money strategy.

- Sideways market: Sell a strangle strategy or buy/sell an at-the-money strategy.

In a subsequent article, we will show you what days of the week these strategies will come in handy. Meantime, you can study these setups to know exactly when to use them in the binary options market.