AUD USD Trade with Binary.com Valued at $100

AUD USD Trade with Binary.com

Today’s trade features the currency pair of the AUDUSD, which has been in a recent free fall. There used to be a time last year when the currency pair was above parity, but those days now seem far off as the pair is currently trading below the 0.8800 psychological barrier. The market bias for the asset was therefore bearish, and we will be looking to take advantage of this in our trade.

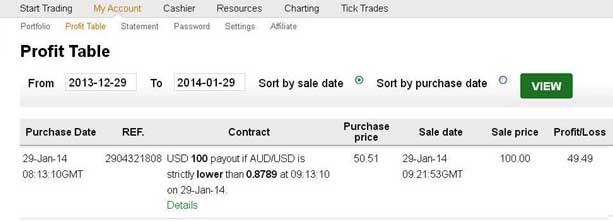

Trade Information

- Asset: AUDUSD

- Binary Options Trade Choice: FALL (Rise/Fall contract)

- Expiry Time: 1 hour

- Entry price: 0.8789

- Investment: $50.51

- Payout: $100

In keeping with the market bias of the asset which was bearish, and maintaining the mantra of the trend being my friend until it ends, I decided to look for an opportunity to trade the contract that would track this bearish move, which was the FALL option in the Rise/Fall contract. The FALL contract states that the AUDUSD would be strictly below the entry price of 0.8789 at my chosen expiry time (9.13am GMT). The trade was setup with an intended payout of $100, and the trade was charged at $50.51.

Trade Outcome

The outcome of the trade was a successful one, with the asset ending the trade at 0.8762, which was a price lower than 0.9789 by the time the trade expired. They payout of $100 was settled and applied to the account.

The Trade Explained

The Binary.com platform is unique in the sense that it is one of the proprietary platforms in the binary options market, allowing for uniqueness in trade types, selection of expiry times and payout structure. Here, the payout is not expressed as a fixed percentage amount. Rather, the trader is at liberty to choose a payout sum, and depending on certain trade conditions, the cost of the trade contracts for both sides of the binary equation is shown. If the trade is deemed too costly by the trader in relation to the payout, the trader may choose not to continue with the trade. In my own case, the trade outcome is one that could not be easily predicted by the broker, so I was charged at $50.51 for my $100 payout selection. The other contract was even costlier.

Having opted to trade the FALL contract due to the long term bearish market bias for the AUDUSD, I decided to look for a technical basis on which to make my trade entry. Charts on the binary options platforms tend to be too rudimentary for chart analysis, so I chose a cTrader chart application to conduct my analysis.

The technical trade entry signal came in the form of a break of the lower trend line within the context of an ascending channel retracement from the downtrend. In other words, I applied a trend line across the price action, which was retracing bullishly from the pre-existing downtrend. I waited until the price action broke the trend line. In this case, the trend line break is one in which the candlestick breaks below the trend line and closes below it. My trading experience has shown that after the break of a trend line, it is normal for price action to try to pullback to the broken level, which we see on the chart below as shown by the yellow arrow.

Once the pullback candle bounced off the broken trend line (which now acts as a resistance), I initiated the FALL option (equivalent to PUT), and setup an expiry time of 1 hour. I chose 1 hour as my expiry time because the analysis for the trade was done on a 1 hour chart where a single candlestick represents price action for 1 hour. Knowing that the pullback candle was unlikely to head up above the trend line but instead more likely to go lower, I considered 1 hour to be a safe expiry time.

Lessons from the Trade

So what lessons can we learn from the trade?

- Binary options are not to be traded randomly, but rather should be traded after careful analyses of the binary options assets in view. Entries and exits must be well-timed and executed.

- Expiry times should be devised from the time frame used for trade analysis.

- Use interactive chart programs which come along with indicators and tools for chart studies to perform analyses of the chosen asset.

- When trading contracts that mirror the direction of price action (such as Call/Put, Above/Below, etc), only trade in the direction of the pre-existing trend. Use the daily chart or 4 hour chart to see which direction the asset is trending.