3M stock to decline on litigation concerns

In the past two months, the share price of Post-it products manufacturer 3M (MMM) had risen 20% to touch a high of $165.33. The main reason for the uptrend was the fourth-quarter revenue and earnings that beat analysts’ estimates. While some traders argue that 3M would rally further above the $200 levels, there are some analysts’ who have a bearish view considering the litigations it currently faces.

In the past two months, the share price of Post-it products manufacturer 3M (MMM) had risen 20% to touch a high of $165.33. The main reason for the uptrend was the fourth-quarter revenue and earnings that beat analysts’ estimates. While some traders argue that 3M would rally further above the $200 levels, there are some analysts’ who have a bearish view considering the litigations it currently faces.

In the fourth-quarter of fiscal 2015, the company recorded sales of $7.298 billion, down from $7.72 billion in the similar period of 2014. Similarly, the net income for the fourth-quarter of fiscal 2015 was $1.04 billion or $1.66 per share, down from $1.18 billion or $1.81 per share in the corresponding period of 2014. The adjusted earnings were $1.81 per share. 3M also announced a $10 billion share buyback program. The forward PE ratio of the company is only 18.

The company recently opened a state of the art R&D center, where scientists from different business divisions would work together to develop better range of products for customers. The company also signed a collaboration agreement with TTS Tooltechnic Systems AG & Co. KG, which owns the Festool brand. The deal will enable the company to become the sole supplier of surface preparation and finishing system. However, all is not well as far as 3M is concerned.

Almost all the chemical companies face some kind of lawsuits. In the latest 10-K form, 3M revealed that it faces lawsuits related to asbestos. Furthermore, it disclosed that there is a likely possibility of further lawsuits being filed on the company for the harmful effect of a compound named PFOA. The compound was supplied to DuPont for the manufacture of Teflon products.

However, in 2008, the company stopped the production of PFOA. The scientists claim that various types of cancer, decreased fertility, high cholesterol and thyroid diseases have some sort of link to the exposure to PFOA. If the claims are found undeniably true, then 3M may end up paying huge amount as fine.

In one of the early PFOA cases, DuPont was fined $1.6 million. Consider the mind boggling amount to be paid in 2,500-3,500 cases of such kind. Thus, investors are wary of making further commitments in companies such as 3M. Thus, considering the issues, it can be safely argued that the stock would remain range bound with bearish bias.

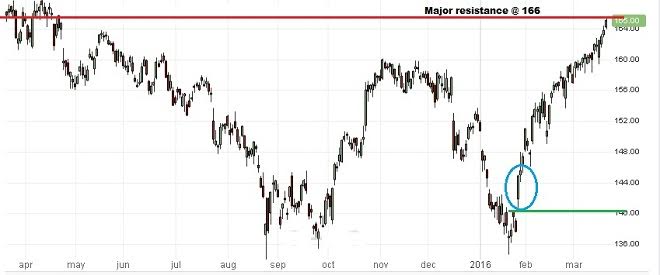

Technically, the stock faces stiff resistance at 166 levels. There exists a technical gap between 140 and 144. Thus, we can expect the stock to decline in the coming weeks.

A binary options trader should purchase a no touch option with expiry in three weeks. The no touch target level should be preferably above $180. There is almost zero probability for the price to breach that level in the next three weeks.